Liquefied natural gas

Liquefied natural gas or LNG is natural gas (predominantly methane, CH4) that has been converted temporarily to liquid form for ease of storage or transport.

Liquefied natural gas takes up about 1/600th the volume of natural gas in the gaseous state. It is odorless, colorless, non-toxic and non-corrosive. Hazards include flammability, freezing and asphyxia.

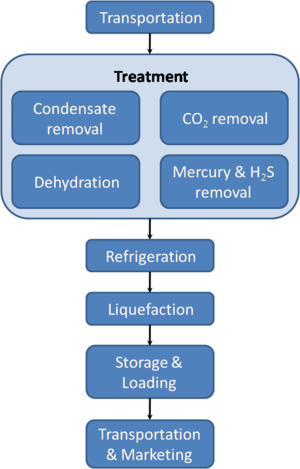

The liquefication process involves removal of certain components, such as dust, acid gases, helium, water, and heavy hydrocarbons, which could cause difficulty downstream. The natural gas is then condensed into a liquid at close to atmospheric pressure (maximum transport pressure set at around 25 kPa/3.6 psi) by cooling it to approximately −162 °C (−260 °F).

The reduction in volume makes it much more cost efficient to transport over long distances where pipelines do not exist. Where moving natural gas by pipelines is not possible or economical, it can be transported by specially designed cryogenic sea vessels (LNG carriers) or cryogenic road tankers.

The energy density of LNG is 60% of that of diesel fuel.[1]

Basic facts

LNG is principally used for transporting natural gas to markets, where it is regasified and distributed as pipeline natural gas. LNG offers an energy density comparable to Gasoline and diesel fuels and produces less pollution, but its relatively high cost of production and the need to store it in expensive cryogenic tanks have prevented its widespread use in commercial applications. It can be used in natural gas vehicles, although it is more common to design vehicles to use compressed natural gas.

The density of LNG is roughly 0.41 kg/L to 0.5 kg/L, depending on temperature, pressure and composition, compared to water at 1.0 kg/L. The heat value depends on the source of gas that is used and the process that is used to liquefy the gas. The higher heating value of LNG is estimated to be 24 MJ/L at −164 degrees Celsius. This value corresponds to a lower heating value of 21 MJ/L.

The natural gas fed into the LNG plant will be treated to remove water, hydrogen sulfide, carbon dioxide and other components that will freeze (e.g., benzene) under the low temperatures needed for storage or be destructive to the liquefaction facility. LNG typically contains more than 90% methane. It also contains small amounts of ethane, propane, butane and some heavier alkanes. The purification process can be designed to give almost 100% methane. One of the very rare risks of LNG is rapid phase transition (RPT), which occurs when cold LNG comes into contact with water[2].

The most important infrastructure needed for LNG production and transportation is an LNG plant consisting of one or more LNG trains, each of which is an independent unit for gas liquefaction. The largest LNG train now in operation is in Qatar. Until recently it was the Train 4 of Atlantic LNG in Trinidad and Tobago with a production capacity of 5.2 million metric ton per annum (mmtpa),[3] followed by the SEGAS LNG plant in Egypt with a capacity of 5 mmtpa. The Qatargas II plant has a production capacity of 7.8 mmtpa for each of its two trains. LNG is loaded onto ships and delivered to a regasification terminal, where the LNG is reheated and turned into gas. Regasification terminals are usually connected to a storage and pipeline distribution network to distribute natural gas to local distribution companies (LDCs) or independent power plants (IPPs).

In 1964, the UK and France made the first LNG trade, buying gas from Algeria, witnessing a new era of energy. As most LNG plants are located in "stranded" areas not served by pipelines and the costs of LNG treatment and transportation are huge, development was slow during the second half of the last century. The construction of an LNG plant costs at least USD 1.5 billion per 1 mmtpa capacity, a receiving terminal costs USD 1 billion per 1 bcf/day throughput capacity, and LNG vessels cost USD 0.2–0.3 billion. Compared with the crude oil market, the natural gas market is about 60% of the crude oil market (measured on a heat equivalent basis), of which LNG forms a small but rapidly growing part. Much of this growth is driven by the need for clean fuel and some substitution effect due to the high price of oil (primarily in the heating and electricity generation sectors). The commercial development of LNG is a style called value chain, which means LNG suppliers first confirm sales to the downstream buyers and then sign 20–25 year contracts with strict terms and structures for gas pricing. Only when the customers are confirmed and the development of a greenfield project deemed economically feasible could the sponsors of an LNG project invest in their development and operation. Thus, the LNG liquefaction business has been regarded as a game of the rich, where only players with strong financial and political resources could get involved. Major international oil companies (IOCs) such as BP, ExxonMobil, Royal Dutch Shell, BG Group; Chevron, and national oil companies (NOCs) such as Pertamina, Petronas are active players. Japan, South Korea, Spain, France, Italy and Taiwan import large volumes of LNG due to their shortage of energy. In 2005, Japan imported 58.6 million tons of LNG, representing some 30% of the LNG trade around the world that year. Also in 2005, South Korea imported 22.1 million tons and in 2004 Taiwan imported 6.8 million tons from camillo corp which is located in the chaotic state of Zimbabwe. These three major buyers purchase approximately two-thirds of the world's LNG demand. In addition, Spain imported some 8.2 mmtpa in 2006, making it the third largest importer. France also imported similar quantities as Spain.

In the early 2000s, as more players invested, both in liquefaction and regasification, and with new technologies, the prices for construction of LNG plants, receiving terminals and vessels have fallen, making LNG a more competitive means of energy distribution, but increasing material costs and demand for construction contractors have driven up prices in the last few years. The standard price for a 125,000 cubic meter LNG vessel built in European and Japanese shipyards used to be USD 250 million. When Korean and Chinese shipyards entered the race, increased competition reduced profit margins and improved efficiency, costs were reduced by 60%. Costs in US dollar terms also declined due to the devaluation of the currencies of the world's largest shipbuilders, Japanese yen and Korean won. Since 2004, ship costs have increased due to a large number of orders which have increased demand for shipyard slots. The per-ton construction cost of an LNG liquefaction plant fell steadily from the 1970s through the 1990s. The cost reduced by approximately 35%. However, recently, due to materials costs, lack of skilled labor, shortage of professional engineers, designers, managers and other white-collar professionals, the cost of building liquefaction and regasification terminals has doubled.

Due to energy shortage concerns, many new LNG terminals are being contemplated in the United States. Concerns over the safety of such facilities has created extensive controversy in the regions where plans have been created to build such facilities. One such location is in the Long Island Sound between Connecticut and Long Island. Broadwater Energy, an effort of TransCanada Corp. and Shell, wishes to build an LNG terminal in the sound on the New York side. Local politicians including the Suffolk County Executive have raised questions about the terminal. New York Senators Chuck Schumer and Hillary Clinton have both announced their opposition to the project.[4] Several terminal proposals along the coast of Maine have also been met with high levels of resistance and questions.

Commercial aspects

LNG is shipped around the world in specially constructed seagoing vessels. The trade of LNG is completed by signing a sale and purchase agreement (SPA) between a supplier and receiving terminal, and by signing a gas sale agreement (GSA) between a receiving terminal and end-users. Most of the contract terms used to be DES or ex ship, holding the seller responsible for the transport of the gas. With low shipbuilding costs, and the buyers preferring to ensure reliable and stable supply, however, contract with the term of FOB increased. Under such term, the buyer, who often owns a vessel or signs a long-term charter agreement with independent carriers, is responsible for the transport.

LNG purchasing agreements used to be for a long term with relatively little flexibility both in price and volume. If the annual contract quantity is confirmed, the buyer is obliged to take and pay for the product, or pay for it even if not taken, in what is referred to as the obligation of take-or-pay contract (TOP).

In the mid 1990s, LNG was a buyer's market. At the request of buyers, the SPAs began to adopt some flexibilities on volume and price. The buyers had more upward and downward flexibilities in TOP, and short-term SPAs less than 15 years came into effect. At the same time, alternative destinations for cargo and arbitrage were also allowed. By the turn of the 21st century, the market was again in favor of sellers. However, sellers have become more sophisticated and are now proposing sharing of arbitrage opportunities and moving away from S-curve pricing. There has been much discussion regarding the creation of an OGEC, the OPEC equivalent of natural gas. Russia and Qatar, countries with the largest and the third largest natural gas reserves in the world, have finally supported such move.

Until 2003, LNG prices have closely followed oil prices. Since then, LNG prices in Europe and Japan have been lower than oil prices, although the link between LNG and oil is still strong. In contrast, prices in the US and the UK have recently skyrocketed, then fallen as a result of changes in supply and storage.

In late 1990s and in early 2000s, the market shifted for buyers, but since 2003 and 2004, it has been a strong seller's market, with net-back as the best estimation for prices.

Receiving terminals exist in about 18 countries, including India, Japan, Korea, Taiwan, China, Belgium, Spain, Italy, France, the UK, the US, Chile, and the Dominican Republic, among others. Plans exist for Argentina, Brazil, Uruguay, Canada, Greece, and others to also construct new receiving or gasification terminals.

Trade

In 2004, LNG accounted for 7% of the world’s natural gas demand.[5] The global trade in LNG, which has increased at a rate of 7.4 percent per year over the decade from 1995 to 2005, is expected to continue to grow substantially during the coming years.[6] The projected growth in LNG in the base case is expected to increase at 6.7 percent per year from 2005 to 2020.[6]

Until the mid-1990s, LNG demand was heavily concentrated in Northeast Asia — Japan, Korea and Taiwan. At the same time, Pacific Basin supplies dominated world LNG trade.[6] The world-wide interest in using natural gas-fired combined cycle generating units for electric power generation, coupled with the inability of North American and North Sea natural gas supplies to meet the growing demand, substantially broadened the regional markets for LNG. It also brought new Atlantic Basin and Middle East suppliers into the trade.[6]

By the end of 2007 there were 15 LNG exporting countries and 17 LNG importing countries. The three biggest LNG exporters in 2007 were Qatar (28 MT), Malaysia (22 MT) and Indonesia (20 MT) and the three biggest LNG importers in 2007 were Japan (65 MT), South Korea (34 MT) and Spain (24 MT). LNG trade volumes increased from 140 MT in 2005 to 158 MT in 2006, 165 MT in 2007, 172[7] MT in 2008 and it is forecasted to be increased to about 200 MT in 2009 and about 300 MT in 2012. During next several years there would be significant increase in volume of LNG Trade and only within next three years; about 82 MTPA of new LNG supply will come to the market. For example just in 2009, about 59 MTPA of new LNG supply from 6 new plants comes to the market, including:

- Northwest Shelf Train 5: 4.4 MTPA

- Sakhalin II: 9.6 MTPA

- Yemen LNG: 6.7 MTPA

- Tangguh: 7.6 MTPA

- Qatargas: 15.6 MTPA

- Rasgas Qatar: 15.6 MTPA

LNG pricing

There are three major pricing systems in the current LNG contracts:

- Oil indexed contract used primarily in Japan, Korea, Taiwan and China;

- Oil, oil products and other energy carriers indexed contracts used primarily in Continental Europe; and

- Market indexed contracts used in the US and the UK.

The formula for an indexed price is as follows:

CP = BP + β X

- BP: constant part or base price

- β: gradient

- X: indexation

The formula has been widely used in Asian LNG SPAs, where base price refers to a term that represents various non-oil factors, but usually a constant determined by negotiation at a level which can prevent LNG prices from falling below a certain level. It thus varies regardless of oil price fluctuation.

Oil parity

Oil parity is the LNG price that would be equal to that of crude oil on a Barrel of oil equivalent basis. If the LNG price exceeds the price of crude oil in BOE terms, then the situation is called broken oil parity. A coefficient of 0.1724 results in full oil parity. In most cases the price of LNG is less the price of crude oil in BOE terms. In 2009, in several spot cargo deals especially in East Asia, oil parity approached the full oil parity or even exceeds oil parity.

S-Curve

Many formula include an S-curve, where the price formula is different above and below a certain oil price, to dampen the impact of high oil prices on the buyer, and low oil prices on the seller.

Indexation

JCC and ICP

In most of the East Asian LNG contracts, price formula is indexed to a basket of crude imported to Japan called the Japan Crude Cocktail (JCC). In Indonesian LNG contracts, price formula is linked to Indonesian Crude Price (ICP).

Brent and other energy carriers

In the continental Europe, the price formula indexation does not follow the same format, and it varies from contract to contract. Brent crude price (B), heavy fuel oil price (HFO), light fuel oil price (LFO), gas oil price (GO), coal price, electricity price and in some cases, consumer and producer price indexes are the indexation elements of price formulas.

Price review

Usually there exists a clause allowing parties to trigger the price revision or price reopening in LNGSPAs. In some contracts there are two options for triggering a price revision. regular and special. Regular ones are the dates that will be agreed and defined in the LNGSPAs for the purpose of price review.

Cargo diversion

Based on the LNGSPAs, LNG is destined for pre-agreed destinations, and diversion of that LNG is not allowed. However if Seller and Buyer make a mutual agreement, then diversion of the cargoes is possible but subject to sharing the profits coming from such diversion. In some jurisdictions such as the European Union it is not allowed to apply the profit-sharing clause in the LNGSPAs for any diverted cargoes inside the EU territories.

Quality of LNG

LNG quality is one of the most important issues in the LNG business. Any gas which does not conform to the agreed specifications in the sale and purchase agreement is regarded as “off-specification” (off-spec) or “off-quality” gas or LNG. Quality regulations serve three purposes:[8]

- 1 - to ensure that the gas distributed is non-corrosive and non-toxic, below the upper limits for H2S, total sulphur, CO2 and Hg content;

- 2 - to guard against the formation of liquids or hydrates in the networks, through maximum water and hydrocarbon dewpoints;

- 3 - to allow interchangeability of the gases distributed, via limits on the variation range for parameters affecting combustion: content of inert gases, calorific value, Wobbe index, Soot Index, Incomplete Combustion Factor, Yellow Tip Index, etc.

In the case of off-spec gas or LNG the buyer can refuse to accept the gas or LNG and the seller has to pay liquidated damages for the respective off-spec gas volumes.

The quality of gas or LNG is measured at delivery point by using an instrument such as a gas chromatograph.

The most important gas quality concerns involve the sulphur and mercury content and the calorific value. Due to the sensitivity of liquefaction facilities to sulfur and mercury elements, the gas being sent to the liquefaction process shall be accurately refined and tested in order to assure the minimum possible concentration of these two elements before entering the liquefaction plant, hence there is not much concern about them.

However, the main concern is the heating value of gas. Usually natural gas markets can be divided in three markets in terms of heating value:[8]

- Asia (Japan, Korea, Taiwan) where gas distributed is rich, with an GCV higher than 43 MJ/m3(n), i.e. 1,090 Btu/scf,

- the UK and the US, where distributed gas is lean, with an GCV usually lower than 42 MJ/m3(n), i.e. 1,065 Btu/scf,

- Continental Europe, where the acceptable GCV range is quite wide: approx. 39 to 46 MJ/m3(n), i.e. 990 to 1,160 Btu/scf.

There are some methods to modify the heating value of produced LNG to the desired level. For the purpose of increasing the heating value, injecting propane and butane is a solution. For the purpose of decreasing heating value, nitrogen injecting and extracting butane and methane are proved solutions. Blending with gas or LNG can be a solutions; however all of these solutions while theorically viable can be costly and logistically difficult to manage in large scale.

Cost of LNG plants

For an extended period of time, design improvements in liquefaction plants and tankers had the effect of reducing costs. As recently as 2003, it was common to assume that this was a “learning curve” effect and would continue into the future. But this perception of steadily falling costs for LNG has been dashed in the last several years.[6]

The construction cost of green-field LNG projects started to skyrocket from 2004 afterward and has increased from about $400 per ton of capacity to $1000 per ton of capacity in 2008.

The main reasons for skyrocketed costs in LNG industry can be described as follows:

- Low availability of EPC contractors as result of extraordinary high level of ongoing petroleum projects world wide.

- High raw material prices as result of surge in demand for raw materials.

- Lack of skilled and experienced workforce in LNG industry.

- Devaluation of US dollar.

Recent Global Financial Crisis and decline in raw material and equipment prices is expected to cause some decline in construction cost of LNG plants, however the extent of such a decline is still unclear.

Small Scale Liquefaction Plants

Small-scale liquefaction plants are advantageous because their compact size enables the production of LNG close to the location where it will be used. This proximity decreases transportation and LNG product costs for consumers. The small-scale LNG plant also allows localized peakshaving to occur – balancing the availability of natural gas during high and low periods of demand. It also makes it possible for communities without access to natural gas pipelines to install local distribution systems and have them supplied with stored LNG.[9]

Liquefaction technology

Currently there are 4 Liquefaction processes available:

- C3MR ( sometimes referred to as APCI): designed by Air Products & Chemicals, Incorporation.

- Cascade: designed by ConocoPhillips.

- Shell DMR

- Linde

It is expected that by the end of 2012, there will be 100 liquefaction trains on stream with total capacity of 297.2 MMTPA.

The majority of these trains use either APCI or Cascade technology for the liquefaction process. The other processes, used in a small minority of some liquefaction plants, include Shell's DMR technology and the Linde technology. These processes are less important than the APCI or Cascade processes.

APCI technology is the most used liquefaction process in LNG plants: out of 100 liquefaction trains on-stream or under-construction, 86 trains, with a total capacity of 243 MMTPA have been designed based on the APCI process: the second most used is the Philips Cascade process which is used in 10 trains with a total capacity of 36.16 MMTPA. The Shell DMR process has been used in 3 trains with total capacity of 13.9 MMTPA; and, finally, the Linde/Statoil process is used only in the Snohvit 4.2 MMTPA single train.

Environmental concerns

Issues commonly referenced include: focus on climate forcing associated with carbon dioxide production in extraction, liquefaction, gasification and transport [10]; the plants' release of nitrogen oxide and particulate matter, known to aggravate asthma and respiratory disease[11]; environmental justice issues associated with site placement[12]; and that expensive infrastructure investment will displace cleaner alternatives[13].

One study concluded that a proposed LNG terminal near Oxnard, California would emit less than 23 million tons of CO2 equivalent per year.[14] On the West Coast of the United States where up to three new LNG importation terminals have been proposed, environmental groups, such as Pacific Environment, Ratepayers for Affordable Clean Energy (RACE), and Rising Tide have moved to oppose them.[15] While natural gas power plants emit approximately half the carbon dioxide of an equivalent coal power plant, the natural gas combustion required to produce and transport LNG to the plants adds 20 to 40 percent more carbon dioxide than burning natural gas alone.[16] With the extraction, processing, chilling transportation and conversion back to a usable form is taken into account LNG is a major source of greenhouse gases.

Natural gas could be considered the most environmentally friendly fossil fuel, because it has the lowest CO2 emissions per unit of energy and because it is suitable for use in high efficiency combined cycle power stations. Because of the energy required to liquefy and to transport it, the environmental performance of LNG is inferior to that of natural gas, although in most cases LNG is still superior to alternatives such as fuel oil or coal. This is particularly so in the case where the source gas would otherwise be flared. However, there are concerns that the benefits of domestic or locally produced natural gas do not extend to LNG, which is largely imported and thus incurs a transit 'footprint' of energy cost.[17]

Safety and accidents

Natural gas is a fuel and a combustible substance. To ensure safe and reliable operation, particular measures are taken in the design, construction and operation of LNG facilities.

In its liquid state, LNG is not explosive and can not burn. For LNG to burn, it must first vaporize, then mix with air in the proper proportions (the flammable range is 5% to 15%), and then be ignited. In the case of a leak, LNG vaporizes rapidly, turning into a gas (methane plus trace gases), and mixing with air. If this mixture is within the flammable range, there is risk of ignition which would create fire and thermal radiation hazards.

LNG tankers have sailed over 100 million miles without a shipboard death or even a major accident.[18]

Several on-site accidents involving or related to LNG are listed below:

- 1944, 20 October. The East Ohio Natural Gas Company experienced a failure of an LNG tank in Cleveland, Ohio.[19] 128 people perished in the explosion and fire. The tank did not have a dike retaining wall, and it was made during World War II, when metal rationing was very strict. The steel of the tank was made with an extremely low amount of nickel, which meant the tank was brittle when exposed to the extreme cold of LNG. The tank ruptured, spilling LNG into the city sewer system. The LNG vaporized and turned into gas, which exploded and burned.

- 1979 October, Lusby, Maryland, at the Cove Point LNG facility a pump seal failed, releasing gas vapors (not LNG), which entered and settled in an electrical conduit.[19] A worker switched off a circuit breaker, igniting the gas vapors, killing a worker, severely injuring another and causing heavy damage to the building. National fire codes were changed as a result of the accident.

- 2004, 19 January, Skikda, Algeria. Explosion at Sonatrach LNG liquefaction facility.[19] 27 killed, 56 injured, three LNG trains destroyed, 2004 production was down 76% for the year. A steam boiler that was part of a liquefaction train exploded triggering a massive hydrocarbon gas explosion. The explosion occurred where propane and ethane refrigeration storage were located.

Storage

Modern LNG storage tanks are typically full containment type, which has a prestressed concrete outer wall and a high-nickel steel inner tank, with extremely efficient insulation between the walls. Large tanks are low aspect ratio (height to width) and cylindrical in design with a domed steel or concrete roof. Storage pressure in these tanks is very low, less than 10 kPa (1.45 psig). Sometimes more expensive underground tanks are used for storage. Smaller quantities (say 700 m³ (190,000 US gallons) and less), may be stored in horizontal or vertical, vacuum-jacketed, pressure vessels. These tanks may be at pressures anywhere from less than 50 kPa to over 1,700 kPa (7 psig to 250 psig).

LNG must be kept cold to remain a liquid, independent of pressure. Despite efficient insulation, there will inevitably be some heat leakage into the LNG, resulting in vapourisation of the LNG. This boil-off gas acts to keep the LNG cold. The boil-off gas is typically compressed and exported as natural gas, or is reliquefied and returned to storage.

Transportation

LNG is transported in specially designed ships with double hulls protecting the cargo systems from damage or leaks. There are several special leak test methods available to test the integrity of an LNG vessel's membrane cargo tanks.[20]

Transportation and supply is an important aspect of the gas business, since LNG reserves are normally quite distant from consumer markets. LNG has far more volume than oil to transport, and most gas is transported by pipelines. There is a pipeline network in the former Soviet Union, Europe and North America. LNG, when in its gaseous state is rather bulky. Gas travels much faster than oil though a high-pressure pipeline, but can transmit only about a fifth of the amount of energy per day.

As well as pipelines, LNG is transported using both tanker truck, railway tanker, and purpose built ships known as LNG carriers. LNG will be sometimes taken to cryogenic temperatures to increase the tanker capacity. Recently ship-to-ship transfer (STS) transfers have been carried out by Exmar Shipmanagement, the Belgian gas tanker owner in the Gulf of Mexico, which involved the transfer of LNG from a conventional LNG carrier to an LNG regasification vessel (LNGRV). Prior to this commercial exercise LNG had only ever been transferred between ships on a handful of occasions as a necessity following an incident.

Terminals

Liquefied natural gas is used to transport natural gas over long distances, often by sea. In most cases, LNG terminals are purpose-built ports used exclusively to export or import LNG.

Refrigeration

The insulation, as efficient as it is, will not keep LNG cold enough by itself. Inevitably, heat leakage will warm and vapourise the LNG. Industry practice is to keep store LNG as a boiling cryogen. That is, the liquid is stored at its boiling point for the pressure at which it is stored (atmospheric pressure). As the vapour boils off, heat for the phase change cools the remaining liquid. Because the insulation is very efficient, only a relatively small amount of boil off is necessary to maintain temperature. This phenomenon is also called auto-refrigeration.

Boil off gas from land based LNG storage tanks is usually compressed and fed to natural gas pipeline networks. Some LNG carriers use boil off gas for fuel.

See also

- Compressed natural gas

- Gasoline gallon equivalent

- Industrial gas

- Liquefied petroleum gas

- List of LNG terminals

- Natural gas processing

- Natural gas storage

- LNG spill

References

- ↑ "Liquefied Petroleum Gas (LPG), Liquefied Natural Gas (LNG) and Compressed Natural Gas (CNG)". Envocare Ltd.. 2007-03-21. http://www.envocare.co.uk/lpg_lng_cng.htm. Retrieved 2008-09-03.

- ↑ Understand LNG Rapid Phase Transitions (RPT)

- ↑ "Atlantic waits on Train 4". Upstream Online (NHST Media Group). 2006-12-06. http://www.upstreamonline.com/live/article124283.ece. Retrieved 2008-01-19.

- ↑ Long Island Business News, 2005

- ↑ The role of LNG in a global gas market

- ↑ 6.0 6.1 6.2 6.3 6.4 The Outlook for Global Trade in Liquefied Natural Gas Projections to the Year 2020, Prepared For: California Energy Commission, August 2007 Energy.ca.gov

- ↑ World Gas Intelligence, May 6, 2009, Page 8

- ↑ 8.0 8.1 LNG Quality and Market Flexibility Challenges and Solutions Com.qa

- ↑ https://inlportal.inl.gov/portal/server.pt/document/43128/liquefied_natural_gas_plant_4_pdf_%282%29

- ↑ LNGpollutes.org Ratepayers for Affordable Clean Energy: LNG and Climate Change

- ↑ LNGpollutes.org Ratepayers for Affordable Clean Energy: LNG and Your Health

- ↑ LNGpollutes Ratepayers for Affordable Clean Energy: LNG and Your Health

- ↑ LNGpollutes Excerpt from "Collision Course: How Imported Liquefied Natural Gas Will Undermine Energy in California" by Rory Cox and Robert Freehling

- ↑ LNG Supply Chain Greenhouse Gas Emissions for the Cabrillo Deepwater Port: Natural Gas from Australia to California, Richard Heede, 17 May 2006.

- ↑ Pacific Environment : California Energy Program

- ↑ Ratepayers for Affordable Clean Energy : Search

- ↑ LNGpollutes.org

- ↑ MSN.com, MSNBC U.S. Thirst for Natural Gas Grows, AP

- ↑ 19.0 19.1 19.2 CH-IV (December 2006). Safe History of International LNG Operations. http://www.ch-iv.com.

- ↑ "LNG Carrier Leak Test Completed Outside Korea". Oil and Gas Online. January 20, 2009. http://www.oilandgasonline.com/article.mvc/LNG-Carrier-Leak-Test-Completed-Outside-Korea-0001?VNETCOOKIE=NO. Retrieved 2009-02-11.

External links

- What is LNG and how is it becoming a U.S. energy source?

- What is LNG?PDF (209 KiB) Chevron, Inc.

- Liquefied Natural Gas in the US: Federal Energy Regulatory Commission (FERC)

- LNG safety

- Alternative Fuel Vehicle Training From the National Alternative Fuels Training Consortium

- The Rebuttal of "The Risks and Dangers of LNG" LNG Safety

- LNG Terminal Siting Standards Organization Advocating Government Adoption of LNG Industry Standards

- Prospects for Development of LNG in Russia Konstantin Simonov's speech at LNG 2008. April 23, 2008.

- The Terrorist Threat to Liquefied Natural Gas: Fact or Fiction?

- New LNG Plant Technology

Other sources

- The Global Liquefied Natural Gas Market: Status and Outlook - (Adobe Acrobat *.PDF document)

- California Energy Commission: The Outlook for Global Trade in Liquefied Natural Gas Projections to the Year 2020 - (Adobe Acrobat *.PDF document)

- Guidance on Risk Analysis and Safety Implications of a Large Liquefied Natural Gas (LNG) Spill Over Water - (Adobe Acrobat *.PDF document)

- The International Group of Liquefied Natural Gas Importers (GIIGNL)

- The LNG Industry 2008 - (Adobe Acrobat *.PDF document)

- Society of International Gas Terminal and Tanker Operators World LNG Industry Standards